NZD/USD Price Analysis: Drops for third day following NZ PM Ardern’s comments

- NZD/USD extends downside following NZ PM cited downside risks to the economy due to China’s coronavirus.

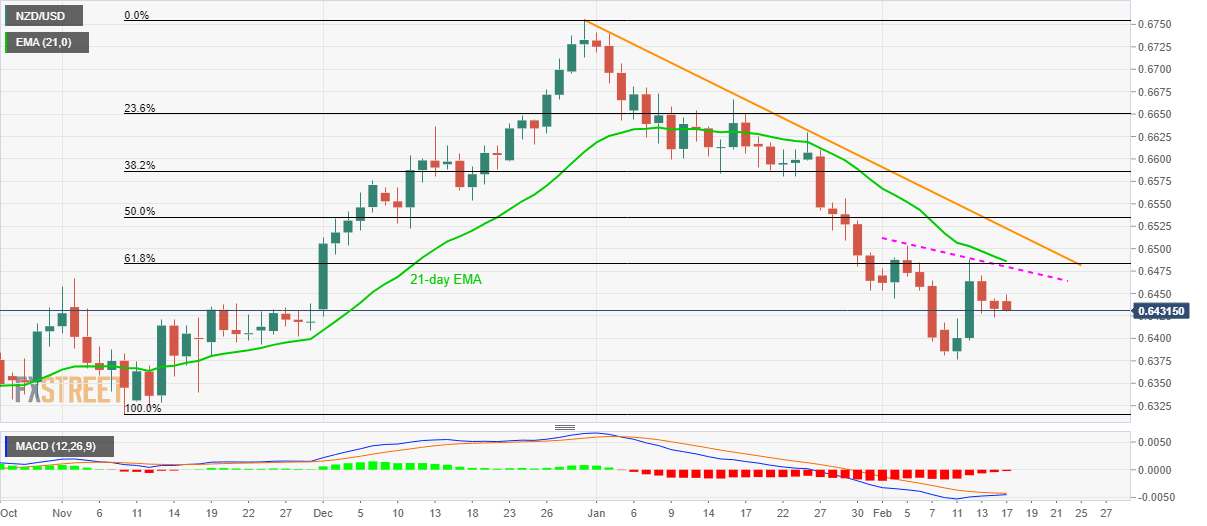

- A confluence of 21-day EMA, 61.8% Fibonacci retracement and short-term falling trendline become the key short-term resistance.

- Monthly lows are on short-term sellers’ radar.

NZD/USD declines to 0.6433 during the early Monday’s trading session. The pair recently reacted to New Zealand Prime Minister Jacinda Ardern’s downbeat comments. Technically, the pair trades below 21-day SMA, eight-day-old falling trend line and 61.8% Fibonacci retracement of its November-December fall.

In addition to the pair’s sustained trading below the key resistance, bearish MACD also favors further declines.

As a result, sellers can now target the monthly bottom surrounding 0.6377 as the nearby support. However, a 0.6400 round-figure can offer an intermediate halt.

If NZD/USD prices remain weak below 0.6377, November 2019 low near 0.6315 will lure the bears.

Meanwhile, an upside clearance of 0.6480/85 resistance confluence could trigger fresh recovery targeting a descending trend line since December 31, 2019, at 0.6525 now.

NZD/USD daily chart

Trend: Bearish